Trends in Automated E-Commerce Packaging Market 2025-35

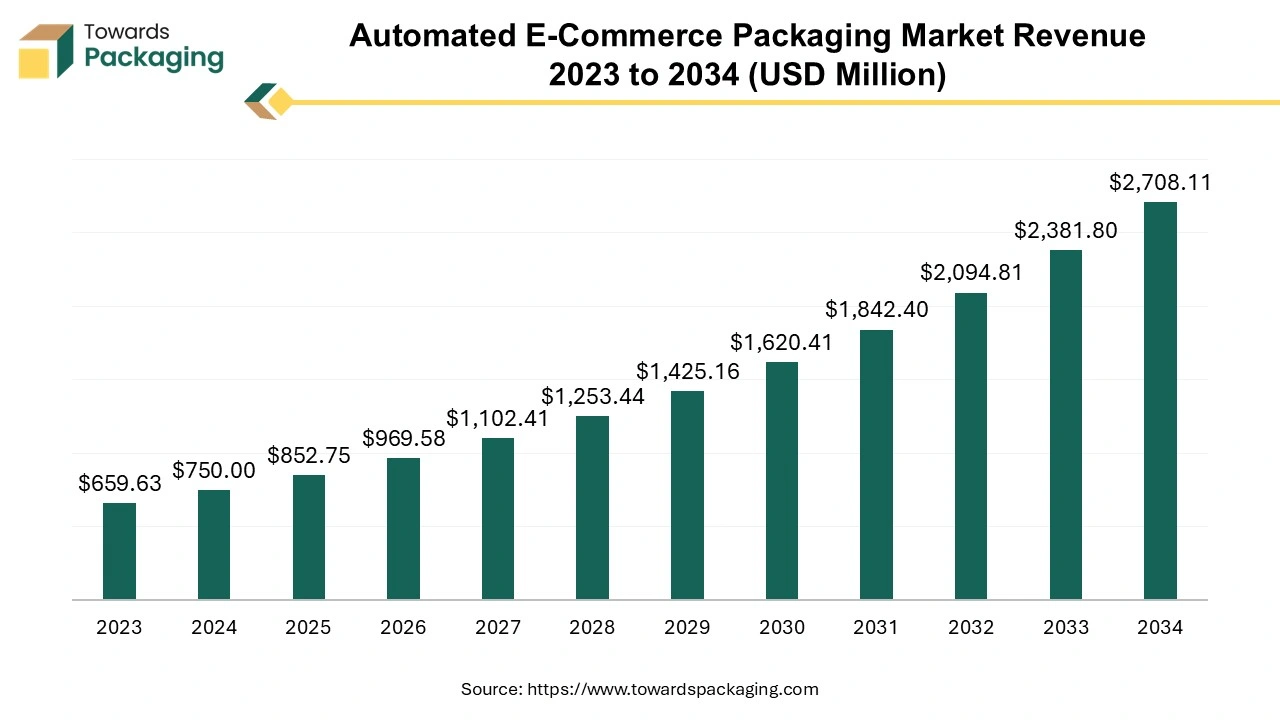

According to researchers from Towards Packaging, the global automated e-commerce packaging market, estimated at USD 852.75 million in 2025, is forecast to expand to USD 2708.11 million by 2034, growing at a CAGR of 13.7% over the forecast period.

Ottawa, Dec. 17, 2025 (GLOBE NEWSWIRE) -- The global automated e-commerce packaging market reported a value of USD 852.75 million in 2025, and according to estimates, it will reach USD 2708.11 million by 2034, as outlined in a study from Towards Packaging, a sister firm of Precedence Research. The automated e-commerce packaging market is expanding as retailers deploy robotics, AI, and smart systems to boost fulfillment efficiency, reduce costs, and meet sustainability demands while handling rising online order volumes.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by Automated E-Commerce Packaging?

The market is driven by rapid growth in online shopping, rising order volumes, labor shortages, and the need for faster fulfillment. Companies adopt automation to reduce packaging time, minimize errors, lower operating costs, improve scalability, and meet sustainability goals through optimized material usage. The market refers to systems and technologies that automatically size, pack, seal, label, and sort products for shipment.

It includes robotics, conveyor systems, AI-enabled software, and smart machines designed to streamline warehouse operations, ensure packaging consistency, protect products, and enhance overall logistics efficiency. Demand is fueled by labor shortages and the need for optimized packaging workflows across sectors such as consumer goods and healthcare. North America leads the market with the largest share, driven by its mature e-commerce ecosystem, advanced infrastructure, and high technology adoption.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5301

Private Industry Investments for Automated E-Commerce Packaging:

- Amcor plc: The company strategically invested in ePac Flexible Packaging in September 2022 to enhance its shareholding and leverage ePac's digital printing and flexible packaging solutions.

- Mondi Group: Mondi partnered with Heiber + Schröder in September 2022 to introduce a rapid automated packaging machine capable of handling up to 500 parcels per hour for online retail operations.

- Ranpak: Ranpak launched its automated solution, Cut'it! Evo, in September 2022, is designed to increase packaging production, lower operational expenses, and improve sustainability through optimized material usage.

- Sealed Air: In May 2019, Sealed Air acquired Automated Packaging Systems, a manufacturer of pouch packaging and loading systems, to expand its breadth of automated solutions and sustainable packaging offerings.

-

Smurfit WestRock: Formed from the 2024 merger of Smurfit Kappa and WestRock, the combined entity creates large-scale opportunities for standardized automation across its extensive network of facilities.

What Are the Latest Key Trends in the Automated E-Commerce Packaging Market?

1. AI-driven smart packaging systems

AI and machine-learning algorithms are increasingly integrated into packaging lines to analyze order patterns, select optimal box sizes, reduce void fill, minimize errors, and improve overall packaging speed and operational decision-making.

2. Right-sized and on-demand packaging

Manufacturers are adopting automated machines that create custom-sized boxes in real time, reducing material waste, lowering shipping costs, improving sustainability, and enhancing product protection during transportation.

3. Robotics and collaborative automation (cobots)

Robots and cobots are being deployed for picking, packing, sealing, and palletizing tasks, helping companies address labor shortages, increase throughput, improve worker safety, and maintain consistent packaging quality.

4. Sustainable and eco-friendly packaging integration

Automated systems are being designed to handle recyclable, biodegradable, and paper-based materials, supporting corporate sustainability goals while reducing plastic usage and aligning with stricter environmental regulations.

5. High-speed packaging for same-day delivery

To meet consumer expectations for faster delivery, companies are investing in high-speed automated packaging lines that integrate seamlessly with fulfillment centers and enable rapid order processing and dispatch.

6. Integration with warehouse management systems (WMS)

Automated packaging solutions are increasingly connected with WMS and order management software, enabling real-time data exchange, inventory accuracy, demand forecasting, and smoother end-to-end fulfillment workflows.

7. Modular and scalable automation solutions

Vendors are offering modular packaging systems that can be easily expanded as order volumes grow, allowing e-commerce companies to scale operations efficiently without completely overhauling existing infrastructure.

What is the Potential Growth Rate of the Automated E-Commerce Packaging Market?

The growth of automated e-commerce packaging is driven by the rapid expansion of online retail and rising order volumes, which require faster and more efficient fulfillment operations. Increasing labor shortages and rising workforce costs push companies to adopt automation to maintain productivity and consistency. Growing demand for same-day and next-day delivery encourages high-speed, accurate packaging solutions.

Sustainability pressures also drive adoption, as automated systems enable right-sized packaging and reduced material waste. Additionally, advancements in robotics, AI, and warehouse integration technologies support smarter, scalable, and cost-efficient packaging operations across e-commerce supply chains.

More Insights of Towards Packaging:

- Hermetic Packaging Market Size, Segmentation, and Competitive Insights (2024-2034)

- Pharmaceutical Plastic Packaging Market Size, Segments, Regional Trends, and Competitive Landscape

- Food Service Packaging Market by Product, End-User, Region, and Key Manufacturers, Competitive Dynamics and Trends

- PCR Plastic Packaging Market Size, Share, Segments, Trends and Key Players (2024-2034)

- Non-Alcoholic Beverage Packaging Market Size, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Fragrance Packaging Market Size, Segments, Regional Insights, and Competitive Landscape

- Packaging Machinery Market Size, Segments, and Regional Analysis (NA, EU, APAC, LA, MEA)

- Compostable Flexible Packaging Market Size, Segments Data, and Regional Insights (NA, EU, APAC, LA, MEA)

- Labeling Machine Market Growth, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Seaweed Packaging Market Size, Segments Data, and Regional Analysis (NA, EU, APAC, LA, MEA)

- Cold Chain Packaging Market Size, Segments, Regional Insights, Comprehensive Competitive Analysis and Key Players

- Tobacco Packaging Market Size, Segments Data, and Regional Insights for 2025-2034

- Aluminium Foil Packaging Market Size, Segments, Regional Data and Competitive Analysis 2024-2034

- Seafood Packaging Market Size, Segments Data and Competitive Analysis (2024-2034)

-

Green Packaging Market Size, Segments Data, North America, Europe, APAC, LATAM, and MEA Insights

Regional Analysis:

Who is the Leader in the Automated E-Commerce Packaging Market?

North America dominates the market due to its highly developed e-commerce ecosystem, widespread adoption of advanced automation technologies, and strong presence of major online retailers and fulfillment centers. High labor costs, persistent workforce shortages, and early investments in robotics, AI-enabled packaging systems, and smart warehousing infrastructure further accelerate automation adoption across the region.

U.S. Automated E-Commerce Packaging Market Trends

The U.S. dominates the North American market due to its massive e-commerce penetration, concentration of global online retailers, and extensive fulfillment and distribution networks. High labor costs and workforce shortages accelerate automation adoption, while strong investments in robotics, AI, and warehouse automation, supported by advanced logistics infrastructure and technology-focused vendors, further strengthen market leadership.

How is the opportunity in the Rise of the Asia Pacific in the Automated E-Commerce Packaging Industry?

Asia-Pacific is the fastest-growing region due to rapidly expanding e-commerce adoption, rising labor costs, and increasing demand for efficient fulfillment. Growing investments in automation, expanding manufacturing bases, and supportive infrastructure development in countries like China and India further accelerate the deployment of automated packaging technologies across logistics and retail sectors.

China Automated E-Commerce Packaging Market Trends

China dominates the market due to its massive online retail volume, highly developed logistics and fulfillment networks, and strong domestic manufacturing capabilities. Rapid adoption of robotics and smart automation, combined with government support for industrial automation and cost-efficient technology production, further strengthens China’s leadership.

How Big is the Success of the Europe Automated E-Commerce Packaging Market?

Europe is a notably growing region in the market due to rising online retail penetration, strong focus on sustainability, and strict packaging waste regulations. Increasing labor costs and shortages are driving automation adoption, while advanced manufacturing capabilities, growing investments in smart warehouses, and rapid expansion of cross-border e-commerce further support market growth across the region.

The UK Automated E-Commerce Packaging Market Trends

The UK dominates the European market due to its high e-commerce penetration, advanced logistics infrastructure, and strong presence of major online retailers and fulfillment centers. Rising labor costs, demand for fast delivery, early adoption of warehouse automation, and emphasis on sustainable packaging solutions further drive market leadership.

How Crucial is the Role of Latin America in Automated E-Commerce Packaging Market?

Latin America is growing at a considerable rate in the market due to increasing internet penetration, rapid expansion of online retail platforms, and improving logistics infrastructure. Rising labor costs, growing urbanization, and investments in warehouse automation by regional and global e-commerce players are further accelerating adoption across the region.

How Big is the Opportunity for the Growth of the Middle East and Africa Automated E-Commerce Packaging Market?

The Middle East and Africa present significant opportunities for automated e-commerce packaging due to rapid urbanization, rising internet and smartphone adoption, expanding online retail platforms, and improving logistics networks. Governments and private investors are funding warehouse modernization, while growing cross-border trade, labor shortages, and demand for faster, reliable delivery encourage companies to deploy scalable, cost-efficient packaging automation solutions across the region.

Segment Outlook

Type Insights

What made the Fully-Automated Segment Dominant in the Automated E-Commerce Packaging Market in 2024?

The fully automated segment dominates the market due to its ability to deliver high-speed, consistent, and error-free packaging for large order volumes. These systems significantly reduce labor dependence, operational costs, and packaging waste while enabling seamless integration with warehouse management systems, robotics, and high-throughput fulfillment centers.

The semi-automated segment is the fastest-growing in the market as it offers a cost-effective entry into automation for small and mid-sized businesses. These systems improve efficiency while retaining operational flexibility, require lower upfront investment, and allow gradual scalability, making them attractive for warehouses transitioning from manual to fully automated packaging operations.

Application Insights

How the Food & Beverage Industry Dominated the Automated E-Commerce Packaging Market in 2024?

The food and beverages dominate the market due to high order volumes, frequent repeat purchases, and strict requirements for hygiene, consistency, and product protection. Automated packaging ensures faster processing, accurate sealing and labeling, reduced contamination risk, and efficient handling of diverse packaging formats for perishable and non-perishable products.

The consumer electronics segment is the fastest-growing in the market due to rising online sales of high-value devices and accessories. Automated packaging ensures precise box sizing, enhanced product protection, reduced damage rates, and efficient handling of complex, fragile items while supporting fast delivery and scalable fulfillment operations.

Recent Breakthroughs in the Automated E-Commerce Packaging Industry

- In April 2025, Packsize completed the acquisition of Sparck Technologies, a strategic move that strengthened its portfolio of high-throughput, fit-to-size automated packaging solutions. This acquisition allows Packsize to integrate Sparck’s innovative machinery, expand global reach, and offer more efficient, flexible, and scalable automated packaging systems to e-commerce and logistics clients, enhancing operational efficiency and sustainability.

- In March 2025, at ProMat and LogiMAT trade shows, Packsize and CMC showcased and launched new automated packaging technologies. Innovations included the Packsize X6 right-sized packaging system and the CMC Super Vertical bagger. These technologies improve packaging accuracy, reduce material waste, increase throughput, and demonstrate how automation is transforming e-commerce fulfillment centers with smarter, faster, and more sustainable solutions.

-

In August 2025, Sparck, now part of Packsize, expanded deployment of its CVP Impack automated packaging machines at WebstaurantStore facilities in the U.S. This real-world implementation highlights growing adoption of advanced automated systems in e-commerce fulfillment. It demonstrates how companies are leveraging high-speed, precise, and scalable packaging technology to improve efficiency, reduce labor dependence, and optimize supply chain operations.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Top Companies in the Global Automated E-Commerce Packaging Market & Their Offerings:

Tier 1:

- BVM Brunner: Manufactures high-speed, fully automatic paper and film wrapping systems that create custom-sized shipping bags from rolls.

- WestRock: Supplies automated fiber-based systems like BoxSizer that adjust box heights to match product dimensions for material efficiency.

- Sealed Air: Offers Autobag high-speed automated bagging systems integrated with smart digital printing and labeling technologies.

- Pregis: Provides the Sharp line of automated poly-bagging machines designed to maximize throughput and minimize manual labor.

- Sparck Technologies: Produces the CVP Everest, a high-capacity machine that measures, folds, and seals custom fit-to-size boxes for every order.

- Maripak: Delivers the Impack Pro series, which automates weighing, right-size packing, and labeling for high-volume e-commerce fulfillment.

- CMC Machinery: Engineering leaders in "Box-on-Demand" technology, providing high-speed systems that create tailor-made boxes for multi-item orders.

- Packsize: Specializes in "Right-sized Packaging on Demand" systems that manufacture custom corrugated boxes instantly at the pack station.

-

Panotec: Features versatile on-demand box-making machines that produce custom corrugated packaging to eliminate the need for pre-made box inventory.

Tier 2:

- Tension Packaging and Automation

- ProMach, Ranpak

- Smurfit Kappa

- Dongguan YiCheng Automation

- JR Automation

- Jiangsu Bealead Intelligent Technology

- Shenzhen Chuangqi Intelligent Equipment

Segment Covered in the Report

By Type

- Fully-automated

- Semi-automated

By Application

- Food & Beverage

- Cosmetics

- Apparel and Footwear

- Consumer Electronics

- Home Appliances

- Household Products

- Pharmaceuticals

- Others

By Region

-

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

-

South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

-

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

-

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

-

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

-

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5301

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight - Check It Out:

- Packaging in Supply Chain Management Market Size, Segments Data and Regional Insights (NA, EU, APAC, LA, MEA)

- Pet Food Packaging Market Size, Share, Segments, and Regional Insights 2025-2034

- Edible Packaging Market Size, Share, Trends, Segments, Regional Insights, and Competitive Landscape 2034

- Antimicrobial Packaging Market Size, Share, Segments, Regional Outlook, and Competitive Landscape, 2024–2034

- Automotive Packaging Market Size, Segments, Regional Outlook, and Competitive Landscape (2025–2034)

- Frozen Food Packaging Market Size, Share, Segments, Regional Outlook, and Competitive Landscape to 2034

- Smart Packaging Market Size, Share, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, and Value Chain Analysis, 2025-2034

- Intelligent Packaging Market Size (2025-2034), Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Companies & Competitive Landscape, Value Chain, Trade, Manufacturers & Suppliers

- E-Commerce Packaging Market Size, Share, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), and Competitive Analysis 2025-2034

- Pharmaceutical Temperature Controlled Packaging Solutions Market Size, Segments, Regional Insights (NA, EU, APAC, LA, MEA), and Competitive Landscape 2025-2034

- Protective Packaging Market Size, Segments, Regional Insights and Competitive Landscape Forecast to 2034

- AI in the Packaging Market Size, Segmentation, Regional Outlook, and Competitive Landscape Report 2025-2034

- Eco-friendly Packaging Market Size, Segments, Regions (NA, EU, APAC, LA, MEA), Companies & Competitive Landscape

- Sachet Packaging Market Size, Segments, and Regional Insights: Comprehensive Industry Analysis (2024-2034)

-

Metal Packaging Market Size, Share, Trends, Segments, and Regional Data (2025-2034)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.